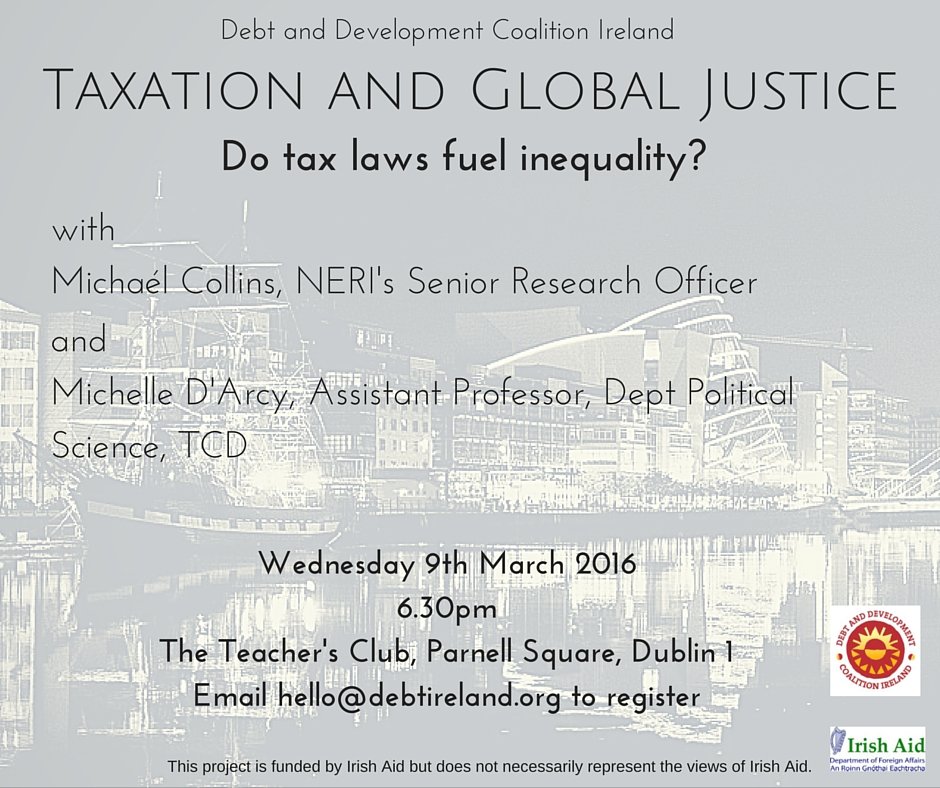

Talk #3: Taxation and Global Justice: do tax laws fuel inequality?

25 February 2016

DDCI Spring 2016 Financial Justice Series

Taxation and Global Justice: do tax laws fuel inequality?

Over recent years increasing attention has been given to the structures multi-national firms use to manage their tax liabilities.

At this event, Michaél Collins (NERI) will examine the structures multinational firms use to manage their tax liabilities, and the growing evidence that the current system needs reform. Michaél will be followed by Michelle D’Arcy (TCD), who will respond to Michaél’s presentation bringing a global South justice perspective to the discussion.

Venue: The Teacher’s Club, Parnell Square

Date: Wednesday 9th March 2016

Time: 6.30 – 8.30pm

Email: hello@debtireland.org to register

Michaél Collins is the Senior Research Officer of the Nevin Economic Research Institute, and his works focuses on income distribution, taxation, economic evaluation and public policy. http://

Michelle D'Arcy is Assistant Professor in the Department of Political Science in Trinity College Dublin, and her work focuses on the effect of institutions on development, and especially at the relationship between democratization and state-building. http://michelledarcy.org/

This is the third in a series of financial justice talks DDCI is hosting this Spring 2016.