Take Action to Stop Corporate Tax Dodging

29 September 2015

It hurts us all when profitable corporations avoid paying their fair share of taxes, using various tricks and loopholes. It denies governments the revenues they need to pay for schools, hospitals and other vital public goods.

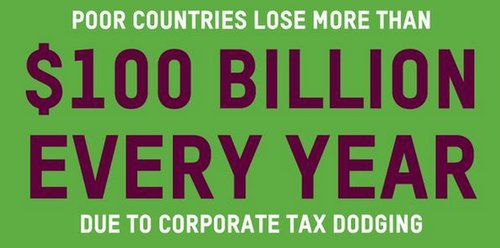

Elaborate corporate tax dodging schemes, including in Ireland, suck billions from the public purse – with people in impoverished countries hardest hit. Tax dodging in poor countries is worth up to three times the entire global aid budget.

LuxLeaks and other scandals have shown state involvement in widespread and systematic tax avoidance by multinationals, including some based in Ireland. Even so, wealthy country governments plan to ‘reform’ the corporate tax system by having multinationals report only to tax authorities their financial and tax details for the different countries where the operate.

To stop tax dodging, we need to look behind multinational companies’ veils of secrecy, see where and how they are declaring their profits, and really tackle the trickery dreamt up by their advisers in tax dodging.

Requiring multinational corporations to report publicly on key financial and tax details for each country where they operate would put it up to them to pay fair taxes where their profits are really earned. It would also help politicians and policy makers determine what needs to be changed to close loopholes in the tax system.

With colleagues from Christian Aid, Oxfam, ActionAid, ATTAC and others working through the forum Tax Justice Ireland, DDCI is urging that Ireland require companies to share publicly where they earn profits and what they pay in tax.

Take Action Now by supporting Oxfam Ireland’s petition to Stop Corporate Tax Dodging.